List of No-Fault States, No-Fault Insurance & What It Means for Drivers

As a driver, you know that car insurance is mandatory in almost every state. The laws across states, however, differ on the type of insurance you need to get. Below, we will cover what is no-fault insurance, which are the no-fault states, and what that means both for insurance companies and drivers.

What Is a No-Fault State

In the United States, car insurance laws fall under several categories — no-fault, choice no-fault, and add-on or tort liability. A no-fault state means that after an accident, each driver is required to file a claim with their own insurance carrier, regardless of who was responsible for the accident.

Verbal and Monetary Thresholds

States with no-fault insurance laws also affect a person’s ability to file a lawsuit for personal injury in a car accident. If the accident happened in a no-fault state, as the driver, you would only be able to sue the responsible driver if your injuries or medical expenses meet a certain threshold. There are two types of thresholds — verbal and monetary. A verbal threshold refers to the severity of the injury (e.g., visible disfigurement), and a monetary threshold means that your medical bills need to reach or exceed a certain amount before you can sue the other driver. You need to consult with your attorney to find out the respective thresholds in your state.

The “Choice No-Fault” Law

There are some states that have a sort of a “hybrid” system, known as the “choice no-fault” law. What this means for drivers in these states is that they can choose whether to get no-fault insurance coverage or a traditional liability-based policy.

An Updated List of No-Fault States

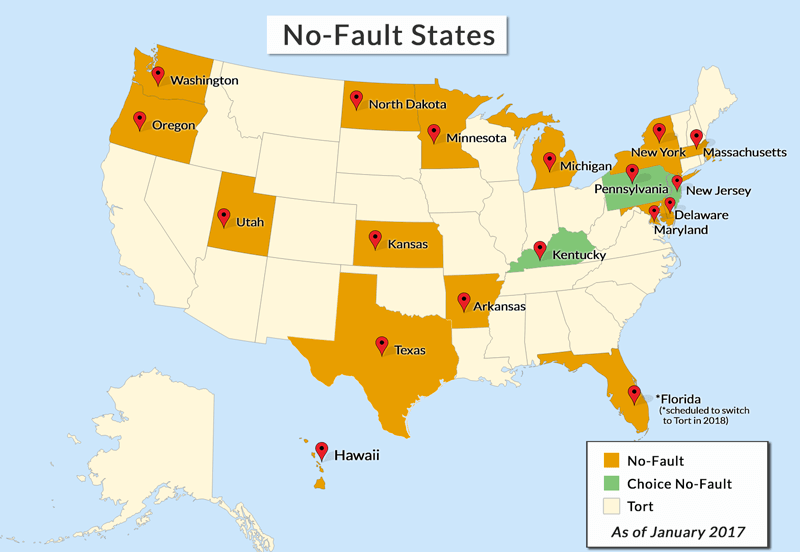

Currently, there are ten states that follow the traditional “no-fault” insurance system, and there are a few that have a “choice no-fault” system. The no-fault states are:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New York

- North Dakota

- Utah

In these states, anyone who gets injured in a car accident must first (and sometimes exclusively) turn to their own insurance company for compensation. There are some exceptions that may allow you to step outside of the no-fault rule, but they vary, and it is best to discuss your options with a personal injury attorney.

Pennsylvania, New Jersey, and the District of Columbia follow a hybrid system (a.k.a. choice no-fault), which means that at the time of purchasing your car insurance policy, you can choose whether to get insured under no-fault or a traditional liability-based insurance system.

Other states, like Delaware and Texas, have add-on insurance laws. This means that insurance companies are required to offer no-fault coverage as an add-on to any car insurance policy. However, if there has been an accident, there are no limitations on the claimant’s options for holding the other driver financially responsible for the damages they have caused.

Keep in mind that while most no-fault coverage can let you claim lost income, medical expenses, and other financial losses (based on your policy limits), vehicle damage claims are usually not part of the no-fault scheme.

No-Fault Car Insurance: the Basics

The reasoning behind no-fault car insurance is simple — it tries to remove the traditional “third-party claim” process and speed things up in terms of getting compensation. The third-party claim process usually requires you to convince the other driver’s insurance company that their insured customer was at fault for the car accident and, thus, has to pay for it.

In most states, when you are injured in a car accident, you typically have the option to bring a compensation claim against the at-fault driver, and it is that driver’s insurance company that has to make the compensation payment.

Proving the other driver’s fault and gathering evidence, however, can be a lengthy and complicated process. In the end, the other driver’s insurance carrier can still deny the claim and force you to file a lawsuit. That is where living in a no-fault state can come in handy because no-fault car accident claims let you streamline the process and file a claim with your own insurance company. Your carrier will then pay compensation for certain financial losses based on your policy, regardless of who has caused the accident. You do not bear the burden of having to convince the insurance adjuster that you are not at fault for the accident.

Car Accident Lawsuits In No-Fault States

Although rare, it is still possible to file a car accident lawsuit against the at-fault driver and their insurance company. However, the claim must meet several thresholds required by state law, which we mentioned above (see Verbal and Monetary Thresholds).

If you have any questions about no-fault insurance, no-fault states, and getting compensation after a no-fault car accident, Legal Chiefs’ network of experienced attorneys is here to help!

Find An Auto Accident Attorney In Your Area

Auto Accident FAQ